What do you do when commodity markets swing? This article will explore how jewelry artists should respond to changes in gold and silver prices.

So, This is The Jewelry Life

Gold and silver prices go up. Gold and silver go down. Up. Down. Up. Down. Metals markets have long, steady stretches punctuated with crazy periods of volatility. During my time in the jewelry industry, I have seen silver range from $7 to $48 per ounce. Shortly after my parents started Halstead in the 1970s, silver prices surged 392% in a single year. Sometimes shifts happen slowly, other times there are sudden leaps.

Experienced jewelers all have tales of past commodity roller coasters. There are moments of triumph when you get lucky on purchase timing. And moments of complete frustration when you get caught on the wrong end of a price swing. If you are new to the jewelry world, metal commodity price runs may seem shocking and unlikely. But this has all happened before and it will all happen again.

These difficult times are part of the jewelry industry, like it or not. Your response during commodity price runs can make or break your studio.

When to Re-Price your Silver Jewelry Collection

Surging gold and silver prices send jewelers into a panic. It is scary to raise prices for customers. It’s a natural fear to worry that clients will stop buying because prices are too high. Yet, you have more latitude with pricing than you may think. Competing jewelers will be responding to cost factors right alongside you. Demand may dip after a price increase, but it will usually recover.

You may hear on the news that silver prices are up 5%. It is unlikely that you will see that full 5% on most of the supplies you use in your jewelry. Raw materials like silver wire, grain, and silver sheet will change the most. Other supplies will change by smaller percentages because the gold or silver price is a lower portion of the overall price.

It makes the most sense to check your material invoices regularly to see your true cost changes. There will always be small fluctuations up and down. If you start noticing differences of 15% or more, consider updating your pricing. The exact trigger should depend on how much margin wiggle room you have in your price structure. If you run a very low-margin operation, you will have to update at a lower trigger threshold such as 5%.

Should you only update gold and silver prices on only new inventory or on your old stock as well?

Wholesale buyers in the jewelry industry are savvier and will want to negotiate with you. But they should also understand that as a business owner you must respond to rising input costs. With B2B accounts it makes more sense to sell off your older inventory at the original prices. It is a great opportunity to promote this merchandise for your wholesale accounts before new pricing updates occur. They will appreciate the heads up and the extra consideration.

Marketing Pivots That Work When Market Gold and Silver Prices Surge

Material price swells can be good for sales. If you adjust your pricing and respond with your marketing, your business can do fine.

When gold and silver prices ramp up it attracts media attention. In a counter-intuitive way, this acts as advertising for the jewelry industry. Consumers hear “gold and silver” on the television and social media. They start thinking about jewelry and are primed to hear your marketing offers.

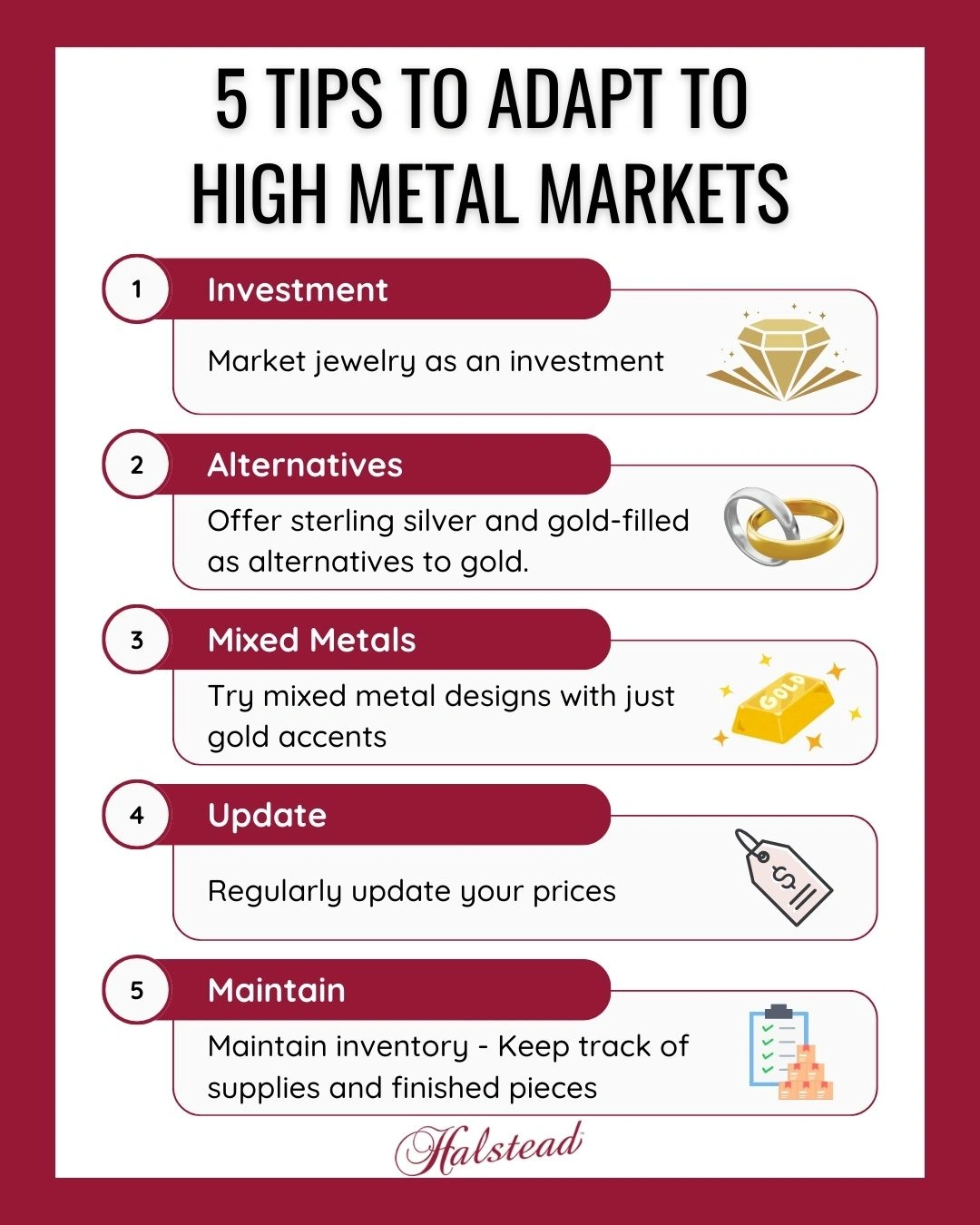

Here are marketing tips to consider.

1. Position jewelry as an investment

Jewelry made from precious metals has intrinsic value. Customers are attuned to luxury and heirloom appeals during these periods.

2. Suggest silver and gold-filled as alternatives to pricey gold

2. Suggest silver and gold-filled as alternatives to pricey gold

Fine jewelry buyers often switch to these bridge metals when they can no longer afford gold and platinum. Promote your collection as an affordable fine jewelry alternative.

3. Stick to your price structure and branding

You will need to update your prices to account for rising material costs. Don’t mark down your jewelry to spur sales. Instead, use smart messaging to show the value of your brand. Discounting will only add financial strain to your business. Some jewelers find that increasing prices on slow sellers can spark more interest.

4. Try mixed metal designs

Experiment with sterling silver jewelry with gold accents to reach different price points and take advantage of gold bug buzz. Some options include karat gold bezels, solder ornaments, granulation, keum-boo foil application, and accent charms.

Managing Your Inventory During Gold & Silver Market Volatility

Inventory management becomes critical during commodity market fluctuations. When prices are surging, it is difficult to remember that they may also crash down the road. Whichever direction prices are moving, large shifts should prompt you to tighten up your inventory to limit your exposure. Here are strategies to help you manage cash flow and get through periods of volatility.

1. Focus repurchasing on your best-selling items

Stock what sells most frequently to generate cash flow. Consider suspending or discontinuing slow moving inventory. Stock that sits on the shelf may become unprofitable. Focus on your core collection.

2. Stock when you need to and don’t gamble on the market

It is tempting to try to time your purchasing to game the market price. This becomes a risky endeavor. No one can get it right all the time. Instead, try to stock steadily as you sell inventory. Over time, your profit margin will average out. You cannot earn money if you are out of stock.

3. Don’t overstock

Unless you are stocking for a holiday, be careful not to overdo it. Pundits are famous for making wild predictions about gold and silver prices only to end up dead wrong. Speculators can cause price trends to suddenly reverse. Then, you may end up overstocked at a market high point. Don’t get caught making this mistake. Buy what you need when you need it.

4. Scrap during price surges

Supply Chain Impact of Gold and Silver Prices

As you move up the supply chain, price update frequency increases. Gold and silver prices as commodities are a larger part of the price for buyers.

Gold and silver prices are updated every second of the day for large scale investment brokers. No joke. That’s called the market “spot” price. These are straight commodity contract purchases; no labor is included in the prices.

Mining and refining processors may price contracts according to the spot price or a “fix” price that is set one time per business day. They will have labor, storage, and processing costs included in their pricing.

Large industrial distributors and wholesale suppliers like Halstead will price using the daily fix rate as well. This level of the supply chain has further costs included in their prices to buyers. Distributors turn over material quickly to minimize exposure to market price trends. If you move large volumes of material, you want to keep the time of sale as close as possible to the time of purchase. This makes revenue and cost of goods more stable and predictable.

Jewelers, solar panel manufacturers, and electronics makers use gold and silver to make goods. As material costs rise and fall, they must adapt to remain profitable and competitive. Adjustments depend on the magnitude of metals cost changes relative to labor and other input costs.

Why Silver Prices Increase

Gold and silver prices change with supply and demand as well as economic indicators. In this section, we’ll explore the market forces that push and pull on gold and silver prices. These forces are all constantly at play. At any given moment, one market force may have more influence than the others to push price responses. At other times, market forces balance each other out and keep prices steady.

1. Supply and demand

When supply exceeds demand, prices tend to fall. When demand exceeds supply, prices rise. Silver and gold demand are impacted by different industries, not just jewelry. For example, the medical and dental fields also use both metals for certain applications. They're also a popular investment instrument. Electronics, such as cell phones and computers, also include silver and gold due to their conductive properties. Silver is an important component in solar panel production which has contributed to price moves in recent years. As demand for all these material uses change, prices are impacted. As supply from both mining and recycling/refining fluctuate, prices change as well.

2. The US Dollar value changes

3. Inflation

Traditional wisdom suggests that people move money to gold as a safe haven when a nation is experiencing inflation. This is a way to hedge against investment losses. The inflation drives demand which in turn pushes gold and silver prices up. As inflation moderates or falls, the opposite force drives prices down. Governments try to moderate inflation by adjusting interest rates. The inflation surge in the 2020s was a major factor in spiking precious metal prices.

4. Global uncertainty

Natural disasters, war, political instability, economic crises, and pandemics push demand up. In turn, that drives gold and silver prices up. Again, precious metals are hedges against investment losses when the world seems shaky. Commodities trade in every country so what is happening in Russia, or anywhere else, can impact gold and silver prices right here in the USA.

5. Speculation

People who invest in gold and silver without intending to use any physical metal are “speculating” that prices will go up and yield profitable returns. These speculators have an outsized impact on precious metal commodities. The reason is that metals market sizes are smaller.

In 2015, for example, the silver market total investment value was about $20 billion; gold was about $170 billion, and oil was $1.7 trillion.[1] The oil market was 10 times larger than the gold market and 85 times larger than the silver market. That means a large investor who takes a multimillion-dollar position in the silver market would have a larger impact. Their investment would be a more significant part of the market size and could be enough to alter prices by impacting demand. A few players in precious metals can cause real price changes. Speculation greatly contributes to volatility in gold and silver prices. When metals markets start moving, they attract the attention of speculators. As they pile in and out of investment positions, prices can swing wildly.

How Halstead Uses Market-based Pricing on Silver and Gold Jewelry Supplies

Our pricing method has been the same for many years. It is described in the Halstead Terms of Sale. Each day, Monday through Friday at about 4pm MST, we update our system pricing based on the market fix price published earlier in the day on the Kitco website. Kitco is a precious metal market resource. Prices are valid on new orders placed until the next update occurs near 4pm on the following business day.

- Prices are locked in when you submit a shopping cart order, not before. Items waiting in your cart from prior days will update on the review order screen so you can check them before finalizing your order.

- If you wish to cancel a submitted order before it ships because of pricing, you are welcome to do so. However, we cannot reserve inventory for you if an order is taken out of the daily processing queue.

- We will not reprice or reinvoice shipped orders, but you are welcome to return them within 30 days per our normal returns policy.

- Returns are refunded based on the price you paid on your invoice.

- Backorders are priced on the day of shipment. You do not lock in a price by backordering stock.

- When we close for a holiday or winter break, we will apply the pricing basis from our last day open to all orders received during the holiday closure. We will resume our daily update procedure on the first day we reopen.

- For any additional questions, please contact our service team at [email protected], or via chat, phone, or contact form.

Further reading:

[1] Desjardins, Jeff (October 14, 2016). The Oil Market is Bigger Than All Metal Markets Combined. https://www.visualcapitalist.com/size-oil-market/