Bank loans are intimidating. But getting financing to fuel your small jewelry business can help you get to the next level. How do you start? What do you need to do? What if you get rejected for a jewelry business loan? You have questions and we have answers.

We all have a general idea about how to pursue a mortgage to buy a home or financing to buy a car. But a jewelry business loan is overwhelming. Commercial loans are different than personal loans. Funding is complicated. You will need to learn the lingo of lending and how to navigate options. Plan to invest time and effort in the process.

You can secure a jewelry business loan in a wide range of amounts for many different purposes. There are several types of lenders in the market including banks, non-profit organizations, and internet lenders. Yet many lenders may consider a jewelry business to be exotic. They may scratch their heads on whether to call you a retailer or a manufacturer. They may not understand the business models that we commonly see in the jewelry field. These are challenges to overcome but they should not stop you from getting the loans you need for your small businesses.

Some of the most common investments made with jewelry business financing include inventory, tools & equipment, commercial lease rents, new employee hires, and commercial space improvements such as displays or workbenches. Loans for these business development purposes are called Working Capital Loans. In this article, we will focus on Working Capital Loans to grow your business.

If you are buying a commercial property for studio and/or retail space, you are looking for a Commercial Real Estate Loan. These loans are generally larger and set for longer time periods. Real estate loans require a down payment. They are backed by the physical real estate asset you purchase. This article will not focus on real estate loans but understand that many of the same principles apply.

When to Get a Jewelry Business Loan

Businesses pursue loans at every stage of growth and development. Loans for start-ups can be more challenging to locate and close. But they are out there if you are prepared and determined. In fact, the loan application process can help to launch your jewelry business with access to training & assistance resources you would not find otherwise.

Small jewelry business loans are not just for new ventures. Mid-career and late-career artists also use loans to fund growth plans of every shape and form. Established businesses may find it easier to get funding if they can show a history of solid small business management experience and profitability.

Also, consider whether your business is ready to take on a steady debt payment obligation. Make sure you have clear goals and forecasted outcomes in mind before you take on risky debt. Do you have enough sales or other income to cover payments? If not, you may need to dedicate time to business development to prepare before your next growth phase. Think about timing.

How to Search for a Small Jewelry Business Loan

Do your research. It can end up saving you thousands and thousands of dollars. It can also save you from committing to a bad loan agreement that jeopardizes both your business and your personal finances. Getting a loan is a big deal. Even though some online lending options seem quick & easy, they may be exposing you to unreasonable costs and unfair risk.

The first step is learning about small business loans in general. SCORE is a free resource for small business start-ups in the USA. They offer training and mentors to help launch new ventures. Start with their article Simple Steps to Choosing the Right Financing for Your Small Business.

Another of the best jewelry business loan resources on the internet is Fundera.com. The website specializes in small business lending education. It is packed with information pages and calculator tools. It also offers quote comparisons to give you a baseline on your lending options.

The Small Business Administration (SBA) local branch offices offer small business loan education clinics online. An introductory session is about 2-hours. SBA loan clinics will answer many of your questions about eligibility and the application process. They can also help you to locate SBA approved lenders in your region. Click here to find your SBA local office.

In the sections ahead, we will give you some basic knowledge about financing and industry-specific insights to help with your jewelry business loan search. If you are not familiar with lending terminology, see our glossary of business loan terms at the bottom of this article.

Where to Get a Small Jewelry Business Loan for Your Studio

Start with a personal or business banker where you have your checking or savings accounts. But understand that traditional banks and credit unions rarely offer microloans for small businesses. They focus on larger, more profitable loans for real estate. Nonetheless, this is an important first step. Your banker is a great resource who can refer you to SBA and CDFI lenders in your area (more on these lenders below).

A banker will ask you how much money you are looking for and how you plan to invest it in your business to get the conversation started. They may encourage you to apply for a bank loan or they may tell you right away that you are not a candidate for a traditional commercial loan. It is up to you if a bank loan sounds like it is worth pursuing, just know that it is not the only option. You can shop around, and it is advantageous to spend the time exploring your choices.

Keep in mind that traditional banks and credit unions require stricter terms and greater collateral than other types of lenders. In exchange, they offer the best interest rates and fixed repayment terms. It is worth taking a shot at a standard loan. If you qualify, you will probably get a competitive deal. If you are rejected or offered financing that seems unaffordable, keep looking. Do not give up. Like all things in small business, persistence is half the battle.

Types of Small Business Loans

Bank Term Loan

We discussed these loans in the previous section. Traditional bank loans are issued by national banks, regional banks, and local credit unions alike.

SBA Microloans

The Small Business Administration (SBA) is a federal agency tasked with supporting small businesses nationwide. This organization receives major funding from taxpayers every year. Part of their mission is backing small business financing loans through a menu of different programs. See what loan programs the SBA offers.

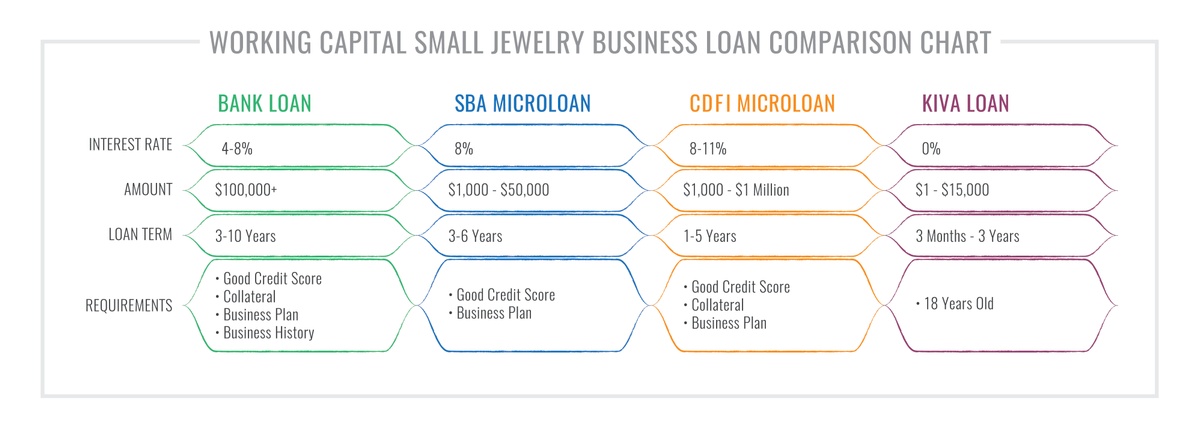

The best fit for most jewelry small businesses seeking working capital is the SBA Microloan. It is a fixed-rate loan at roughly 8% APR for amounts under $50,000. The average microloan is about $13,000. Loans are issued for a maximum of six years, but most are three-year terms. These loans are backed by the SBA but administered by intermediaries such as banks and non-profit CDFIs described in the next section.

CDFI Lending

Community Development Financial Institutions (CDFIs) are usually non-profit community organizations funded in part with federal tax dollars. However, some banks and credit unions may also have a CDFI designation. They are committed to a mission of economic development for small business owners who would otherwise have difficulty getting traditional bank financing.

Many CDFI lenders focus on supporting minority or women-owned small businesses. Others prioritize rural areas or struggling urban zones. Jewelry businesses often meet one or more of these criteria. CDFI lenders will want to know about your potential impact on the community in terms of jobs, skills training, or revitalization.

CDFIs Go Beyond Capital Financing

The CDFI mission goes beyond access to capital. A CDFI certification requires a lender to offer a full slate of support services, called “Technical Assistance,” - similar to small business classes. Free Technical Assistance training curriculums vary between organizations. But they typically include classes such as marketing, breaking even, hiring employees, and product pricing. A CDFI is a great option for jewelers for a few reasons. Many jewelry artist-entrepreneurs are female and/or BIPOC. They are frequently start-ups with very little credit history. Some are business owners recovering from bad credit. All these conditions meet the missions of the CDFI program.

Beyond demographics, jewelry is a unique field. Few bench jewelers, metalsmiths, or designers have a background in business. Most find their way into the jewelry world because of their creative talents. Jewelry artists may lack the business management skills needed to run a business when they first start. But those skills are accessible through CDFI Technical Assistance programing. “Jewelry artists need to understand that they can really benefit from the services. And often those resources are free or very affordable,” said Gwynne Rukenbrod Smith, a Project Manager of Craft Your Commerce at Mountain Bizworks - a CDFI in Asheville, NC.

Gwynne has noticed jewelers struggle to form a target customer profile. Jewelers often focus on the same small audience of one-percenters, the wealthy elite. But there are many other audiences out there that you may resonate better with to build a following. “Technical Assistance workshops and coaching can help you really narrow into your customer and then be strategic about where you go to sell your work successfully,” she said.

Setting aside time to focus on development is necessary to build a business. An easy first step is to sign up for a local CDFI’s mailing list to receive notifications of workshops and services. Then, meet with an intake coach to identify resources that are the best fit for your type of business and stage in development.

Applying For A CDFI Small Business Loan

According to Michael Dunmire, a Growth Loan Officer at CDFI Bridgeway Capital, lenders don't approve loans if a candidate fails to create a thorough business plan. Lenders are investing money in your small business. They expect to see a plan in place that shows you can meet the loan payment obligations for the entire term of the loan. But a CDFI lender wants to see you succeed. If you don't qualify for a loan when you first try, ask questions so you can prepare and try again later.

Eventually, you will need a business plan and financial statements to complete a loan application. But Caroline Valvardi of Opportunity Finance Network adds, “Many CDFIs will help guide small businesses in preparing these items.” Her organization recommends that candidates come to their first meeting prepared with three things.

- Your Story – Your small business idea including how you fit with the CDFI’s mission to help underserved borrowers

- Your Need – As much information as possible about why you need a loan and what it will accomplish

- Financial Documents – Even if you don’t have financial statements prepared for your business, plan to bring your personal bank statements and tax returns to get the conversation started.

CDFIs use grassroots leaders and resources to meet the needs of their communities. They usually serve a small region ranging from a few counties up to several states. So, it is best to use geographic terms to find local options. Search “CDFI loan + your state” in your search browser. Then reach out to see if you meet their mission-based criteria.

The US Treasury also offers an updated list of all CDFIs in the country. You will need to visit the CDFI Fund website to download the list of CDFI’s. Then search for your city or state.

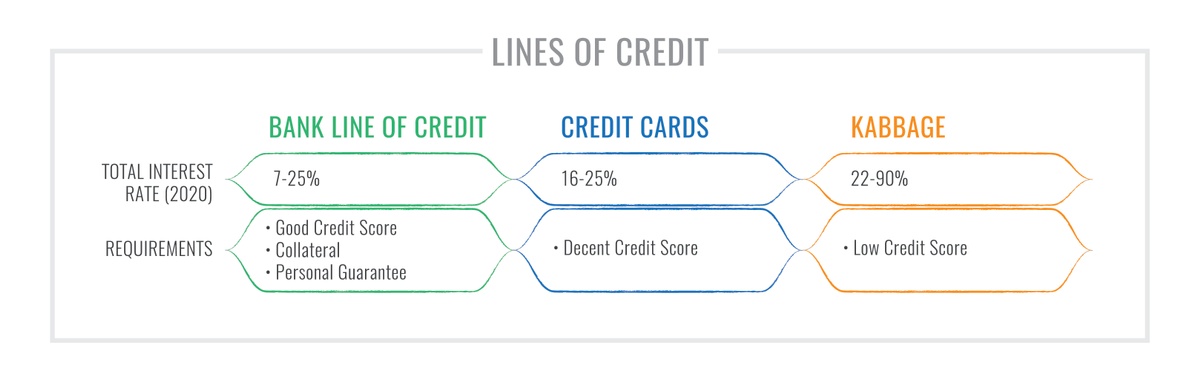

Credit Cards and Lines of Credit

A line of credit is a specific type of commercial loan that allows for open-ended revolving borrowing up to a set credit limit. This type of loan is best for inventory buildup or to even out seasonal cash flow highs and lows. You can add to the principal at any time up to your credit limit. You are required to meet minimum monthly payment amounts but may easily reduce your balance by paying down the principal more aggressively.

Credit cards are an unsecured line of credit that is based on your credit score. Credit cards may offer reward incentives such as cashback or discounts. Commercial lines of credit may require collateral and a personal guarantee but will offer higher credit limits and be at much better interest rates for those who qualify. Online lenders such as Kabbage offer quick and easy lines of credit but charge extremely high interest rates.

Kiva Microlending

Kiva is a hybrid lender that merges the concept of loan crowdfunding with a non-profit mission to provide access to capital for entrepreneurs around the world. The company was established in 2005 and has an excellent track record of both impact and repayment. The organization specializes in loans up to $15,000 at 0% interest for a maximum of 3 years.

Emergency loans

Special loans are available for small businesses that sustain physical or economic damage during a national crisis such as the COVID-19 pandemic, a personal tragedy like a fire, or a natural disaster such as a hurricane. Amounts, terms, and criteria will vary. However, disaster loans are designed to accommodate challenging circumstances and therefore offer flexible terms and requirements.

See these resource links for options:

- CERF The Artists Safety Net

- SBA Disaster Loans

- FEMA Disaster Assistance – Borrowers who do not qualify for SBA Disaster Loans may meet requirements for FEMA Grants if a federal emergency has been declared.6

Working Capital Small Jewelry Business Loan Comparison Chart

What is Required to Get a Small Jewelry Business Loan?

You do not need to have a federal Employer Identification Number (EIN) or state business license when you start a loan application. But most lenders will require you to complete those registrations before a loan can close.

Lenders require evidence that your business will generate enough cash flow to consistently cover debt payments. Any type of lender you choose will want a business plan. If you need help assembling a plan and required financial statements, lenders can often refer you to local resources such as SCORE offices, entrepreneurship centers, or community colleges and universities that sponsor small business support programs. There are ways to get the help you need. Learn what small business support organizations like SCORE and SBDCs offer.

How to Apply for a Small Business Loan for your Jewelry Business

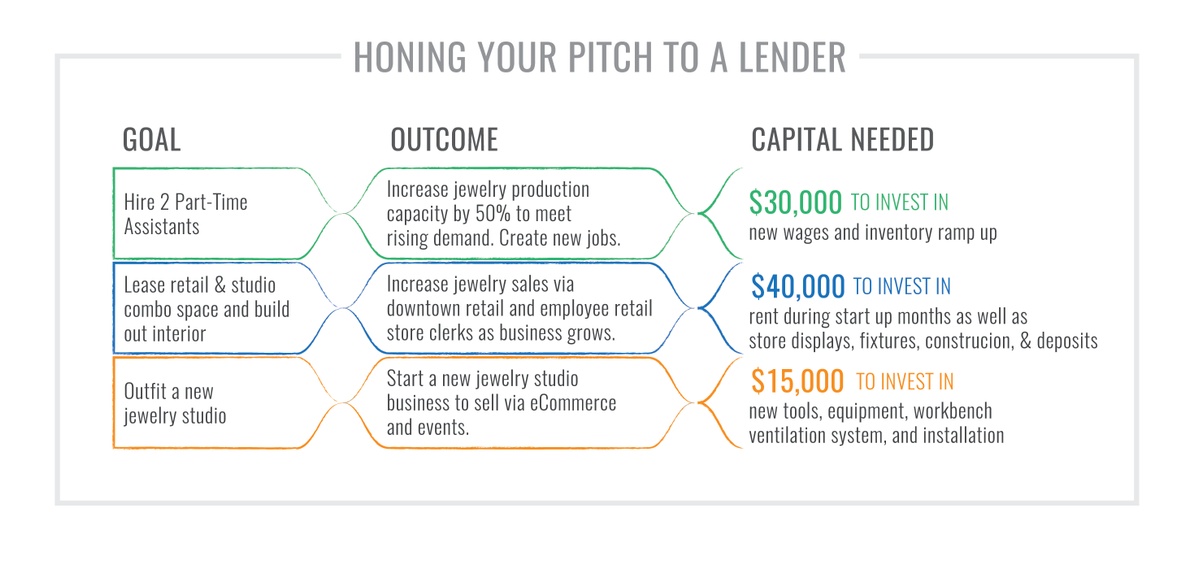

1. Develop Your Pitch

Know your audience. Getting a loan is a different conversation than selling your jewelry. Bankers and lenders will be less interested in your artist statement and design inspiration yet much more interested in the numbers behind your business. Be prepared to talk about your business goal that requires funding, the outcome you can reasonably expect from your investment, your implementation timeline, and the amount of capital you need to make it happen.

The examples below show some of the most common reasons that small jewelry businesses get funding. These abbreviated models show the pieces of information that a lender will want in your first meeting. The more information you can provide, the better. Lenders expect to see due diligence. Break down timelines, purchasing lists, and contingency plan details.

Honing Your Pitch to a Lender: Examples for Jewelry Businesses

2. Practice Explaining What You Do as a Jewelry Studio Artist

A lender may not immediately understand your business model. They are likely to think of you like a chain jewelry store such as Jared or a manufacturer using 3-D printers to churn out stock. They may not have the context and experience to imagine a jewelry studio operation. Wear sample pieces of jewelry to give them a visual. Practice articulating your business model by describing these points clearly and concisely:

- What techniques and tools you use

- Where you sell your jewelry

- Who your target customers are

3. Meet with a Banker

With your pitch prepared, set an appointment with a banker at the bank where you have a checking or savings account. Bank loans are difficult, but this is an important first step for several reasons. First and foremost, banks offer the lowest fixed-rates on commercial loans. If you get approved, this may be the best deal on the market. Second, if a bank loan is not a good fit for you or you get rejected, a banker can still help you. They are likely to know alternative lenders and small business organizations in the area. A banker can connect you with organizations that can either lend to you directly or help you to prepare your business to reapply later.

4. Prepare a Business Plan and Financial Statements

To get a small business loan, you will need to write a business plan. This document will include an overview of your business and your financial statements. Take the time to do it right. Remember that writing a business plan is about more than getting a loan. It is a goal-setting exercise that will help your business succeed. Look at this assignment as an opportunity to legitimize your business and build your career.

A jewelry business loan application will require basic financial statements before you submit final paperwork. It is okay to get help to create financial statements. Your accountant or local SCORE chapter can advise you.

5. Submit Application & Follow Up

Don’t think of your application submission as the end of the road. Be prepared to ask questions and request details if your application is rejected. It is not defeat. This is just like jewelry show jurying. You must have a thick skin and keep trying. Ask for feedback on where you fell short. Ask for resources to help improve your business. Take a deep breath and keep pushing forward. You can do this.

Funding Alternatives to a Jewelry Business Loan

Traditional jewelry business loans are not always the best option for funding. If any of the following circumstances apply to you, consider these alternatives.

- Lack of steady revenue to cover payments

- You are recovering from a poor credit history

- You are a homeowner with part of the mortgage principal paid down

Home Equity Lending

If you are a homeowner with equity built up in your property, consider using a home equity loan or line of credit for your business. These personal loans are often available at better rates than commercial lines of credit because the loan is secured by your home as collateral. This option only makes sense if you are the sole owner of your business. If you have one or more partners, then it is complicated and extra risky to use the home of just one owner for financing. Also understand that this comes with risk to your residence if you default on the loan.

Grants

Grants offer cash for your small jewelry business. These awards often involve a competitive application process. Funds are provided by endowments, non-profit organizations, or business sponsors. Eligibility criteria and application processes vary tremendously.

General small business development grants are often specific to a state or region. Your best resource for location-based grants is your nearest SBA Office.

Here are a few of the best grant programs currently available for jewelry business owners.

- The Halstead Grant – for emerging silver jewelry entrepreneurs

- WJA Grants and Scholarships – several awards available for early career and mid-career jewelers

- Windgate-Lamar Fellowship – for graduating college seniors and graduate students in the arts

- The Tory Burch Foundation – for women entrepreneurs

Crowdfunding

Online crowdfunding is a creative way to build capital for your business. Websites like Kickstarter and GoFundMe pioneered this space. More specialized niche crowdfunding platforms like iFundWomen emerged in recent years. Funding candidates create a compelling pitch story and then offer perks for funding donations for their start-up. Listings often compete for dollars from browsing investors. Perks are usually swag items or merchandise from the business. This option works best if you have an established network of personal and/or business connections to help the effort gain momentum.

Merchant Client Loans: Shopify Capital and Paypal Loans

Your e-commerce platform or credit card processor may offer small business loans for established clients. These companies have access to data on your business transaction history so they can calculate risk and credit limits based on your prior relationship. If you have been with a service provider for several years or more, you are a good candidate for their lending services.

A primary advantage of these loans is that repayment may be based on a percentage of your monthly or weekly sales instead of fixed payment amounts. That means the loan can flex with your business seasonality as needed. However, be warned, rates and penalties can be extremely high. These options are alluring because they are so quick and easy compared to bank lending, but they may not be the best options for your business.

- Shopify Capital for Shopify store owners

- PayPal Term Business Loans and PayPal Working Capital for Business Account holders

Online Loans

The internet age yielded online lenders such as Kabbage. These services make a jewelry business loan application process easier. But rates and penalties are often concealed by fixed payments and lack of complete disclosures. Use caution when choosing these lenders. Make sure you compare with other loans and ask questions before committing to a risky deal.

Refinancing Your Jewelry Business Loan

If you are in the start-up phase of your business or recovering from poor credit, you may have to settle for an expensive, high interest rate loan to get funding. However, once you establish a good payment history, your credit score will improve. With a couple of years of reliability and business stability under your belt, you may become a good candidate for refinancing at better terms. Talk to your original lender about options and compare choices from other lenders.

The Vocabulary of a Jewelry Business Loan

There is a lot of technical lingo involved in loans. This glossary of terms will help you to understand the mechanics of lending so you can make informed decisions. If you are already familiar with these terms, feel free to scroll to the next section.

Collateral – An asset or assets owned by the loan borrower to back up or “secure” a loan. The lender can claim ownership of these designated assets if the borrower defaults on the loan. Collateral decreases the risk associated with a loan because the lender can recoup some of their losses through the sale of the asset. Business loans are often collateralized using a lien against the business itself or assets like inventory. Personal loans are usually collateralized with a home

Personal Guarantee – A contractual promise from the business owner(s) to be personally responsible for the loan repayment if the business cannot meet the loan agreement. Guarantees are unsecured so they are not backed by specific assets. Instead, the bank can sue you personally for repayment. You could be forced to pay the loan from your personal bank accounts or through wage garnishment, for example. Such actions would also hit your personal credit score.

Traditional Term Loan – Standard loans are secured using collateral and issued by banks for a set loan term period at a disclosed interest rate. Standard commercial loan terms are usually 2-6 years for working capital loans. However, there are many variations that tweak these details. Or, non-traditional loans issued by different types of lenders with different conditions.

Short-Term Loan – Loans with terms between 3 months and 24 months are considered short-term.

Unsecured Loan – These loans do not require collateral to back up the loan. Unsecured loans are higher risk for the lender, so interest rates are usually higher. They are more common for borrowers who have a lower credit score or are early career business owners in the startup phase of a business launch.

Microloan – Working Capital loans for $50,000 or less are considered microloans. These loans are a specific product category with unique terms and limitations. Many banks do not offer microloans. They are more common through non-profit lenders and the SBA. Some microloan providers make specific allowances for small business start-ups that do not have the minimum operating history required for other types of loans.

Principal – The loan amount that you will receive to use for your business.

Interest Rate – Interest is much like a rental rate that you pay for use of a large sum of money upfront. You pay back the sum of the loan plus interest to compensate the lender for the loan service and risk they assumed in trusting you to pay back the debt. Interest is usually given as an Annualized Percentage Rate (APR) of the principal. But, watch out! Some lenders assess MONTHLY percentage rates on the principal. When comparing loans, make sure you know how interest will be calculated and review your schedule of monthly payments.

Fixed vs. Variable Rates – Traditional loans set a fixed interest rate at the time of lending and do not change during the loan term. Variable-rate loans may float with market conditions over the months or years of your loan term. Traditional loans are predictable, so you know exactly what payments you are committed to each month. Variable-rate loans are much riskier because rates can change dramatically over short time periods and make a big impact on your monthly payment requirements. Be sure you know if your interest rates are fixed or variable before you agree to a loan. If you don’t understand how rates change during the term of your loan, ask questions to clarify before you sign anything.

Loan Term – Traditional loans are issued for a set period of time that is disclosed upfront. Commercial loans are typically shorter-term than personal loans. Small business loans are usually given for a period of 6 months up to a maximum of 5 years. You will not see the lengthy time spans of residential mortgages that are usually 15 year or 30-year terms.

Loan Fees – Lenders tack on a variety of fees that can drive up the cost of a loan. Ask pointed questions about all fees that may apply. Some include application fees, origination fees, processing fees, prepayment penalties, and closing fees.

Monthly Payments – Each month, you will pay interest on your loan plus a portion of the principal amount. At the beginning of your loan, your payment is mostly interest and very little principal. As you progress through the loan term, payments shift to become mostly principal and less interest as you gradually pay down the debt. Upon signing a fixed rate standard loan, you should receive a schedule of payments with a consistent monthly payment amount due for a certain number of months or years.

Debt-to-Equity Ratio – Bankers use this metric a lot and it may mean the difference between approval and rejection for your loan application. What is it? This decimal figure represents a quick view of a small business’s ability to repay its obligations or its stability. It is calculated by taking your total business liabilities and dividing them by your owner’s equity. This number will range from 0 to about 1.5 at the very high end. Lenders want to see low Debt-to-Equity ratios, less than .4, to qualify you for standard loan terms and rates. Companies with higher ratios are more “leveraged,” which means they are risker and will pay higher interest rates if they qualify for loans at all.

Owner’s Equity – Also called shareholder equity, this is the amount of personal investment you have in your business. Over time, this number may increase beyond the initial cash you chipped in to get started. It is calculated by looking at your balance sheet and subtracting your total liabilities from your total assets.

Default – Late, or delinquent, payments will eventually put a loan into default. This is a breach of contract. The borrower will go into collections, take a hit to their credit score, and likely lose their collateral for failing to meet debt obligations. These recourse steps help the lender to recoup as much of the outstanding principal as possible.

You may also like these business articles:

How to Start a Jewelry Business